Blog

The One Thing Every New Grandparent MUST Do As Soon as Possible

Congratulations on welcoming the newest addition to your family. Being a new grandparent changes everything -- including how you...

Four Reasons Why Estate Planning Isn’t Just for the Top 1 Percent

There is a common misconception that estate plans are only for the ultra-rich - the top 1 percent, 10%, 20%, or some other arbitrary...

3 Things You Must Do Once Your Divorce Is Final

The divorce process can be long and expensive. However, the work does not end once the divorce decree is signed. In order to ensure...

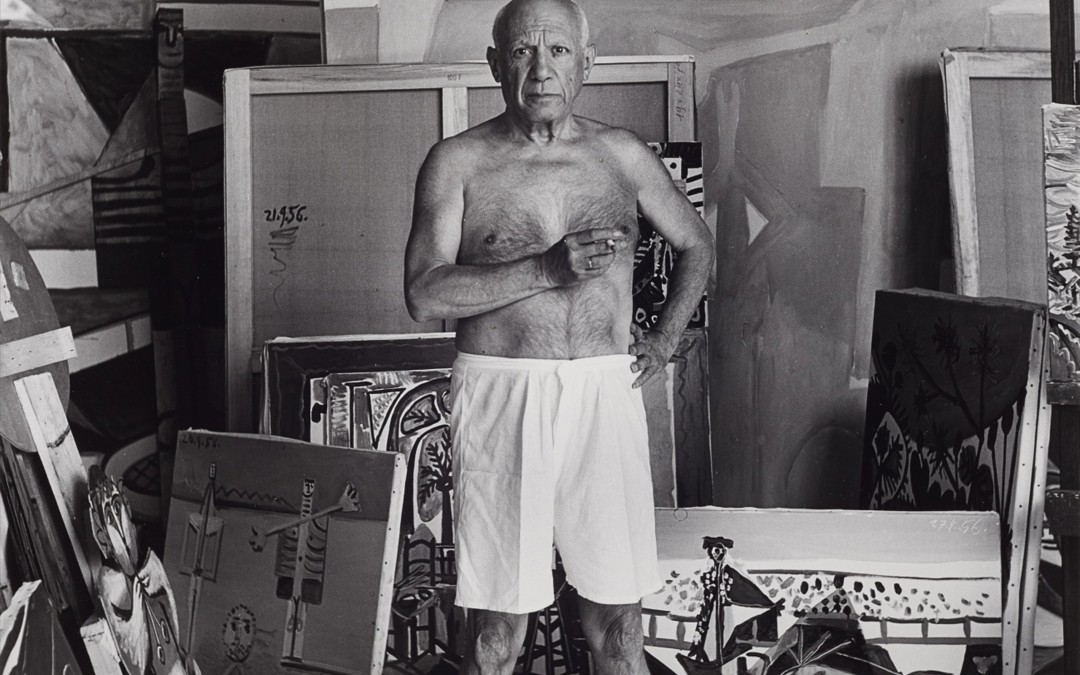

What These 4 Famous Estate Planning Debacles Can Tell You About Proper Planning

Are you failing your family the way these 4 celebrities failed theirs? These four celebrity estate planning fiascos offer lessons...

Why a Spendthrift Trust Can Be a Great Solution for Your Heirs

There are many tools that can be used when putting together your estate plan. One such tool is a trust. A trust is a fiduciary...

How You Can Build an Estate Plan that Includes Asset Protection

Much of estate planning has to do with the way a person’s assets will be distributed upon their death. But that’s only the tip of...